Are you considering applying for a loan with Billshappen? It’s essential to do your research before committing to any financial institution. In this billshappen loan reviews blog post, we delve into Billshappen loan reviews, addressing the burning question on everyone’s mind: Is it legit?

Additionally, we explore the speed of obtaining quick funds through Billshappen. By the end of this article, you’ll have a clearer understanding of the legitimacy of Billshappen and whether it offers the swift funding you need.

Table of contents

Overview of Billshappen Loan

BillsHappen® is an intelligent marketplace that aims to connect individuals in need of a personal loan with reputable lenders. With a focus on providing hassle-free financial assistance, BillsHappen® offers a straightforward and secure platform for borrowers to access the funds they require quickly.

Now let us move on to the next section of the billshappen loan reviews blog post.

Key Features

You may also like: Kennedy Funding Reviews | Birch Lending Reviews | Panther Lending Reviews | protectspecial.com rEviews | MyTPL Loan Reviews | Infinity Plus Advantage | Global Capital Partners Fund Reviews

- Easy Request Process: BillsHappen® simplifies the loan application process, making it convenient and user-friendly. Through their platform, borrowers can easily submit their loan requests, eliminating the need for extensive paperwork and time-consuming procedures.

- Fast Decisions: One of the standout features of BillsHappen® is the speed at which borrowers can receive loan decisions. In some cases, borrowers may be able to secure funds from a lender as early as the next business day*, allowing for prompt financial support when it’s needed most.

- Safe & Secure: BillsHappen® prioritizes the privacy and security of its users. They employ the latest SSL (Secure Sockets Layer) technology to ensure that personal information remains confidential throughout the loan application process.

By leveraging the BillsHappen® marketplace, borrowers can save time and effort by gaining access to a network of reputable lenders who are ready to provide the financial assistance they need. Whether it’s for unexpected expenses, home repairs, or debt consolidation, BillsHappen® aims to facilitate a seamless and secure borrowing experience.

*Note: The availability of funds and the timing of loan disbursement may vary depending on the lender and other factors.

Now let us move on to the next section of the billshappen loan reviews blog post.

Minimum Amount to Borrow

When it comes to borrowing funds through BillsHappen®, flexibility is key. Whether you need a small amount for a specific purpose or require a larger sum to cover substantial expenses, BillsHappen® caters to a wide range of borrowing needs.

Minimum Borrowing Amount: $1,000

With BillsHappen®, borrowers have the option to borrow as low as $1,000. This minimum borrowing amount is ideal for individuals seeking a smaller loan for immediate financial requirements or unexpected expenses. Whether it’s covering medical bills, repairing household appliances, or managing short-term cash flow, BillsHappen® allows borrowers to access the funds they need without a high minimum threshold.

Maximum Borrowing Amount: $5,000

On the other end of the spectrum, BillsHappen® also offers the opportunity to borrow up to $5,000. This higher borrowing limit enables borrowers to tackle more substantial expenses or consolidate larger debts. Whether it’s funding home renovations, planning a wedding, or managing multiple outstanding debts, BillsHappen® provides the flexibility to secure a loan amount that meets your financial goals.

It’s important to note that the specific loan amounts available within the range of $1,000 to $5,000 may depend on individual factors such as creditworthiness, income, and other lending criteria set by the participating lenders. However, BillsHappen® strives to connect borrowers with lenders who can accommodate their desired borrowing amount whenever possible.

By offering a wide range of borrowing options, BillsHappen® aims to provide borrowers with the financial flexibility they need to navigate life’s ups and downs. Whether you require a small loan or a larger sum, BillsHappen® is here to assist you in finding a reputable lender that suits your borrowing needs.

Now let us move on to the next section of the billshappen loan reviews blog post.

How does It work?

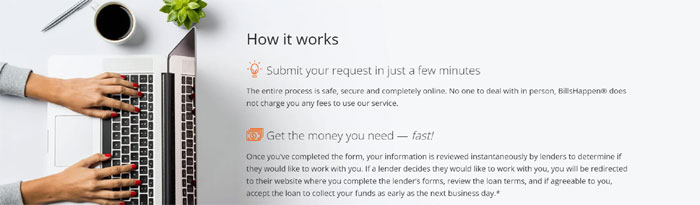

Getting the financial assistance you need through BillsHappen® is a simple and efficient process designed to provide convenience and speed. Here’s a step-by-step overview of how it works:

- Submit Your Request: Begin by submitting your loan request through the BillsHappen® platform. This can be done easily and quickly in just a few minutes. The entire process takes place online, eliminating the need for face-to-face interactions and paperwork. Moreover, BillsHappen® does not charge any fees for using their service, ensuring a hassle-free experience for borrowers.

- Instantaneous Review: Once you’ve submitted your request, your information is promptly reviewed by a network of participating lenders. They assess your request to determine if they would like to work with you based on factors such as your creditworthiness and financial situation. This instantaneous review process saves time and allows for swift decision-making.

- Lender Selection and Loan Agreement: If a lender decides to work with you, you will be redirected to their website. There, you will complete the lender’s specific forms and have the opportunity to review the loan terms they offer. It’s crucial to carefully go through the terms to ensure they align with your needs and financial capabilities.

- Acceptance and Fund Collection: After reviewing the loan terms, if you find them agreeable, you can proceed to accept the loan offer. Once you’ve accepted the loan, you can expect to receive the funds as early as the next business day*. The exact timing of fund disbursement may vary depending on the lender and other factors, but BillsHappen® aims to facilitate a speedy process.

Throughout the entire process, BillsHappen® prioritizes the safety and security of your personal information. They utilize advanced technology, including SSL encryption, to protect your data and maintain privacy.

By following these straightforward steps, BillsHappen® enables borrowers to access the funds they need quickly and conveniently. It’s a reliable and efficient platform that connects borrowers with reputable lenders, ensuring a seamless borrowing experience.

Now let us move on to the next section of the billshappen loan reviews blog post.

Contact Information

If you need to get in touch with BillsHappen® for any inquiries, support, or assistance, you can reach them through the following contact details:

Mailing Address: BillsHappen® 7580 NW 5th Street #15614 Plantation, FL 33318

Email Address: For general inquiries or information, you can send an email to info@billshappen.com. The BillsHappen® team will strive to respond to your email promptly and address any questions or concerns you may have.

Feel free to reach out to BillsHappen® using these contact details for any assistance related to their services or any other relevant matter.

Billshappen Loan Reviews: What are Customers Saying?

BillsHappen® has garnered a strong reputation among its customers, with numerous positive reviews highlighting the quality of their services. Customers who have availed themselves of their financial assistance have expressed their satisfaction with the platform. While specific testimonials can be found on BillsHappen®’s blog pages, a broader search on Google reveals an abundance of positive reviews from people who have had positive experiences with the company.

These reviews shed light on the exceptional service and benefits that customers have enjoyed when working with BillsHappen®. Customers appreciate the convenience and efficiency of the online application process, emphasizing the ease of submitting loan requests within minutes. The streamlined process has received praise for its user-friendly interface, saving customers valuable time and effort.

Furthermore, customers have expressed their satisfaction with the speed at which their loan requests were processed. BillsHappen®’s ability to promptly match borrowers with suitable lenders has been a standout feature, allowing borrowers to receive loan decisions quickly. Many customers have reported receiving funds as early as the next business day*, which has proven crucial in urgent financial situations.

The positive reviews regarding BillsHappen®’s customer service and support are also worth noting. Customers have praised the responsiveness and professionalism of the BillsHappen® team, highlighting their willingness to address queries and provide guidance throughout the borrowing process. The emphasis on maintaining a safe and secure environment for personal information has been positively acknowledged, fostering trust and confidence among customers.

Overall, the consensus from customer testimonials and online reviews suggests that BillsHappen® has successfully delivered on its promise of a reliable, efficient, and customer-centric lending experience. The positive feedback highlights the platform’s ability to connect borrowers with reputable lenders, providing a hassle-free and secure way to obtain the financial assistance they need.

Is It Legit?

After conducting a thorough investigation of the company, it has been determined that BillsHappen® is indeed a legitimate and trustworthy financial institution. Several factors contribute to its legitimacy, providing customers with confidence and assurance when using their services.

Certified

Firstly, BillsHappen® holds certifications from reputable entities such as Trutes Sites and Secured By, further validating its credibility. These certifications highlight the company’s commitment to maintaining high standards of security and reliability, ensuring customer information remains protected.

Detailed Contact Information

Additionally, BillsHappen® provides detailed and accurate contact information, allowing customers to easily reach out for any queries or concerns they may have. The transparency in providing this information demonstrates the company’s commitment to open communication and customer support.

Detailed FAQs

BillsHappen® goes a step further by addressing common questions and concerns through a dedicated Frequently Asked Questions (FAQ) section on their website. This comprehensive resource serves as a valuable guide, providing clear and informative answers to commonly raised queries, further enhancing customer trust.

Review by YouTuber

Furthermore, independent reviews from reputable sources such as YouTuber Nikhil Anand, who has a substantial subscriber base, have confirmed the legitimacy of BillsHappen®. In their review, they explicitly stated that BillsHappen® is a legitimate company, lending further credibility to its operations.

Scam Adviser

Another reliable source, Scamadviser, rates BillsHappen® with a high trust index of 100 out of 100. This rating demonstrates the website’s security and trustworthiness, assuring users that their interactions with the website are safe and reliable.

In conclusion, based on the detailed examination of BillsHappen® and considering various indicators such as certifications, transparent contact information, positive reviews from reputable sources, and high trust ratings, it can be confidently stated that BillsHappen® is a legitimate and trustworthy platform. Customers can have peace of mind when utilizing their services for their financial needs.

Things to Consider

APR Disclosure: The Annual Percentage Rate (APR) for cash advance loans and installment loans can vary among different lenders and states. Some states have laws that limit the maximum APR a lender can charge. Loans from states without such limiting laws or from banks not governed by state laws may have even higher APRs. The APR reflects the interest rate at which your loan accumulates and is based on various factors such as loan amount, term, repayment schedule, and associated costs. Before entering into a loan agreement, lenders are legally obligated to provide you with the APR and other terms. It’s crucial to review this information carefully, understand the loan terms, and be aware of the total repayment amount.

The Operator of the Website: It’s important to note that the operator of the BillsHappen® website is not a lender. They do not broker loans or make/fund any product offerings, loans, or credit decisions. The website serves as a secure platform to submit your information to potential lenders. However, submitting your information does not guarantee approval for a loan product. BillsHappen.com may undergo changes without prior notice.

Credit Checks: Lending partners, at their discretion, may perform credit checks using the three major credit reporting bureaus (Experian, Equifax, TransUnion) or alternative providers. This assessment helps lenders evaluate your creditworthiness and determine the terms and conditions of the loan.

Accuracy of Information: While BillsHappen.com strives to provide accurate and up-to-date information, the content on the website is for convenience only. BillsHappen.com does not guarantee the accuracy of the information provided. It’s advisable to consult with a financial professional and consider your individual circumstances before making any financial decisions.

New York Residents: BillsHappen® services are not available to borrowers in New York due to the interest rate limits imposed by New York law.

It’s important to carefully review the terms, conditions, and disclosures provided by lenders through BillsHappen®. If you have any questions or concerns about your application, it is recommended to contact your lender directly for clarification.

Remember, all financial decisions should be made based on your unique situation and after careful consideration. BillsHappen.com is not responsible for any financial actions taken based on the content of its site.

Please note that “BILLSHAPPEN®” is an exclusive trademark of WWMG, LLC, and any unauthorized copying, distribution, or dissemination of its content is strictly prohibited.

By understanding these considerations, you can make well-informed decisions when utilizing the services of BillsHappen®.

Now let us move on to the next section of the billshappen loan reviews blog post.

Pros and Cons

PROS:

- Hassle-free and convenient online loan request process.

- Fast funding potential, with funds sometimes available as early as the next business day*.

- Secure and private information handling with the use of the latest SSL technology.

- Reputable lenders participating in the BillsHappen® marketplace.

- Positive customer reviews and testimonials showcasing customer satisfaction.

- Transparent APR disclosure and loan terms provided by lenders.

- Dedicated FAQ section addressing common queries and concerns.

CONS:

- APR rates can vary between lenders and states, and some loans may have higher APRs.

- Approval for a loan is not guaranteed, as it depends on the lender’s assessment and eligibility criteria.

- Potential credit checks performed by lending partners, which may impact credit scores.

- Availability of services may vary by location, with New York residents not eligible for BillsHappen® loans due to state law restrictions.

Conclusion: Billshappen Loan Reviews

In conclusion, based on the available information and customer reviews, Billshappen has proven to be a reliable and reputable platform for finding personal loan lenders. Customers have praised the easy request process, fast funding potential, and the security measures in place to protect their information. The positive customer testimonials and high trust ratings indicate that Billshappen has successfully met the needs of borrowers, providing them with hassle-free financial assistance. However, it’s important for borrowers to consider factors such as APR rates and eligibility criteria before making borrowing decisions. Overall, Billshappen offers a promising option for individuals seeking quick funds through a trusted marketplace.

Alternative Options

- Traditional Banks: Consider approaching traditional banks for personal loan options. Banks often offer competitive interest rates and established customer service. However, the application process may be more rigorous, and approval can take longer.

- Credit Unions: Explore credit unions as an alternative to BillsHappen. Credit unions are member-owned financial institutions that offer various loan options at potentially lower interest rates. They prioritize personalized service and may have more flexible eligibility criteria.

- Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers directly with individual lenders. These platforms offer competitive interest rates and may have more flexible lending criteria than traditional banks. However, borrowers should carefully review the terms and fees associated with each platform.

- Online Lenders: Numerous online lending platforms provide quick and convenient loan options. Research reputable online lenders that offer competitive rates, transparent terms, and positive customer reviews. However, be cautious of high-interest rates and ensure the lender is licensed and trustworthy.

- Credit Card Cash Advances: If you have an existing credit card, consider utilizing a cash advance feature. However, be mindful of potentially high interest rates and fees associated with cash advances. It’s crucial to understand the terms and repayment requirements before proceeding.

- Borrowing from Family or Friends: If possible, consider reaching out to family or friends for financial assistance. Make sure to establish clear terms and repayment plans to avoid straining personal relationships.

Remember to carefully evaluate the terms, interest rates, repayment plans, and eligibility criteria of each alternative option before making a decision. Choose the option that best fits your financial situation and aligns with your long-term financial goals.

Frequently Asked Questions

How does the loan request process work?

The loan request process with Billshappen is simple and straightforward. You can submit your loan request online by providing the necessary information. Once submitted, reputable lenders in the BillsHappen network will review your request and determine if they would like to work with you.

What is the minimum and maximum loan amount I can borrow?

The loan amount you can borrow through Billshappen varies, with a minimum amount as low as $100 and a maximum amount of $5,000. The specific loan amount available to you will depend on various factors, including your creditworthiness and the lender’s policies.

How quickly can I receive the funds if my loan is approved?

In some cases, you may receive the funds from a lender as early as the next business day*. However, the exact timing of fund disbursement can vary depending on the lender and the loan agreement.

Are there any fees associated with using Billshappen’s services?

No, Billshappen does not charge any fees to use their service. However, keep in mind that lenders may have their own fees and charges, which will be disclosed to you before you accept the loan.

Is my personal information safe and secure?

Yes, Billshappen takes the security and privacy of your personal information seriously. They use the latest SSL technology to encrypt and protect your data, ensuring it remains confidential and secure.

What if I have a poor credit history or no credit at all?

Billshappen works with lenders who consider borrowers with various credit backgrounds. While having good credit can increase your chances of loan approval, having poor credit or no credit history doesn’t automatically disqualify you from applying. Lenders in the network may still review your loan request and make a decision based on their individual criteria.

Can I repay my loan early?

Repaying your loan early is a possibility with some lenders; however, it’s important to check the terms and conditions of your loan agreement. Some lenders may charge prepayment penalties or fees, while others may allow for early repayment without any additional charges.