Everyone is striving hard to make ends meet. We all have certain problems in our lives. However, the financial crisis is a major problem in many ways. You never know when such circumstances may arise. It is always important to keep a backup. This will save you from a lot of embarrassment and difficult situations. See More: Mctrpayment Com Legit

However, sometimes a crisis may arise. You need money for personal reasons such as hospital bills, electricity bills, loan repayments, tuition fees, etc. Taking up loans in such circumstances has made our lives much easier. It would be best if you are looking for a reliable, cooperative, and trustworthy lender.

You can even look for lenders online now. 5k Funds is a reputable company that has been around for more than seven years. Let us have a detailed 5k Funds review to choose the best option for our readers.

5k Funds services

5k Funds is an online lending platform. This well-established market offers free services, providing more than 100 approved lenders in a single place. They offer personal loans, which may include any reason. 5k Funds application process is easy, with a good credit score to qualify for a loan, and because you need to match the lender’s requirements to get your loan approved.

The interest rate depends on your credit score. The higher your credit score, the lower the interest rate is. Let us look into further details and the process of getting a loan through 5k Funds. Don’t Miss: Loyal Lending Reviews

Eligibility criteria of 5k Funds

You may also like: Loggerhead Insurance Reviews | Kennedy Funding Reviews | Birch Lending Reviews | Panther Lending Reviews | One Partner Advantage Reviews | protectspecial.com rEviews | Rate Chopper Loan Reviews

5k Fund is a simple criterion for people eligible to get a loan. The following are the sets of rules that make you eligible for it.

- You must be at least 18 years old to apply for a loan.

- The borrower must be a citizen of the US.

- A regular source of income should be present.

- An active bank account is required for direct deposits.

- The borrower must possess a valid phone number and an active email address.

Read More: Coffee Break Loans Reviews

How to Apply for a Loan?

There are a few easy steps to apply for a loan at 5k Funds.

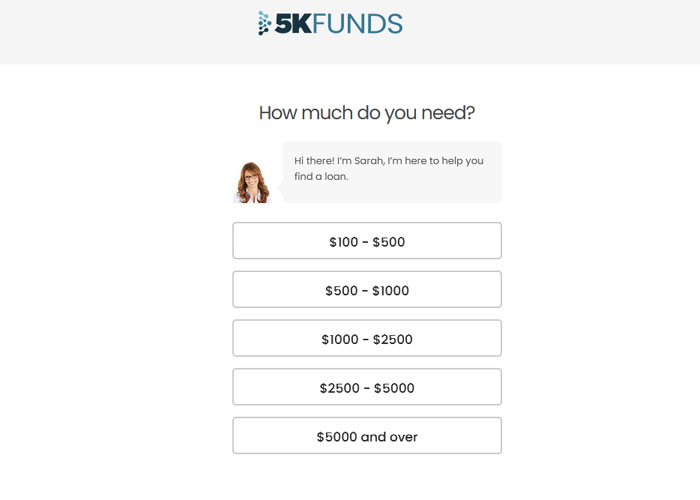

- You need to visit the official website of 5k Funds.

- Then select the amount of loan you require.

- Then select the amount of time you need to pay back the loan.

- Enter your personal information, including name, zip code, and email ID.

- Provide your employment details, gross monthly income, pay frequency, etc.

- Enter your further personal details, such as your driving license, ABA routing number, state ID number, and ABA routing number.

- Then, enter your bank details including your bank name, account number, account type, and deposit functionality.

- Now, submit your application form.

As the application is processed, you will receive responses from many lenders and because You need to check their requirements and contact the one that goes with your preference.

Fee and further charges

5k Funds have lenders whose Annual Percentage Return varies from one to another. It usually ranges from 5.99% to 35.99%. However, this platform does not charge the borrowers themselves. You do not have to pay any hidden fee later on. But some lenders here impose certain charges.

Don’t Miss: Financial Shield Reviews

Repayment Terms

You can choose the loan repayment time while filling out the application form. 5k Funds allow you to repay the loan within 61 days to 72 months. Now, it is your choice to pay the debt twice a month or once to your lender.

5k Funds comparison with other lenders

| 5k Funds | Monevo | Fiona |

| APR Range 5.99% – 35.99% | APR Range 2.49% – 35.99% | APR Range 4.99% – 35.99% |

| Min. Credit Score N/A | Min. Credit Score 600 | Min. Credit Score 620 |

This shows that 5k Funds have no limit requirement for a minimum credit score, while others have. On the other hand, Monevo and Fiona have a lower APR range as compared to 5k Funds.

Customer reviews about 5k Funds

We went through Trustpilot to find out if the website was legitimate. It only shows a 2.0 rating with 73% of poor reviews. People are quite disappointed with them.

A client says he was tricked into credit reporting services. Another one says that it is not safe. They sell your personal information further. Another customer says that he has applied for even a $200 loan for the past few months, but all in vain. It hardly shows any good reviews. Would Like: Innovation Refunds Reviews

A patron claimed to have received the money on the same day and was able to renovate his kitchen because he was very satisfied with the 5K Funds.

PROS:

- There are no minimum credit requirements

- The application process is free

- Multiple options for loan terms are available

- A good network of more than 100 lending partners

CONS:

- There is no helpline number

- Non-responsive customer service

- There is no option for live chat

- Poor trust score and reviews on other sites

Final statement

We provide a 5k Funds review to find the best lender online. There are various pros and cons to the company. This well-managed website seems to be quite helpful. They even give a money-back guarantee with interest. However, the reviews on other sites do not support that it is safe. A slight doubt still exists, and we recommend you go for a background check before providing personal and bank details.