Are you facing financial problems? Is there an issue with paying medical bills? Do you need to rent a home but are a little short on money? Then, why struggle with everything on your own? Many people out there are ready to help you. You cannot tackle your problems without stressing yourself.

Many online websites offer loans at a reasonable interest rate. You need to search for the one that fits your needs. Here, we bring you faster pockets loans reviews. It offers a loan to the one who readily needs it. The terms and conditions are pretty simple yet good. Let us have a look at their services. Related: Mctrpayment Com Legit

About Faster Pockets Loans

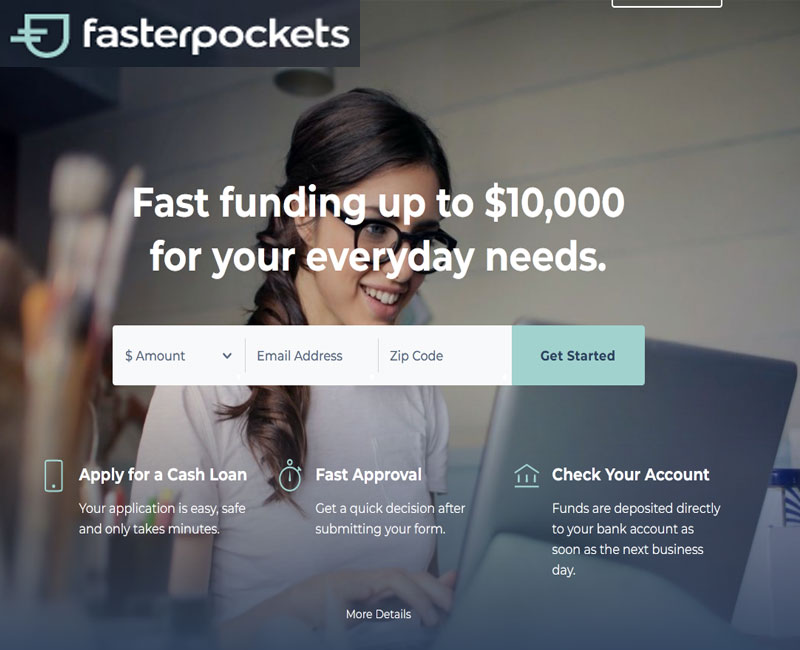

Faster pockets loans is an online platform that offers you money for a specific period. They tend to offer you loans for a short duration. They aim to solve your problems within minutes. As the name suggests, it works pretty fast compared to others. This is a secure website; you can entrust them with your data.

Faster pockets loans accept every type of credit. You can now pay back their short-term loans easily. The approval barely takes five to ten minutes. Once it gets approved, you get the money as soon as possible.

Related: Loyal Lending Reviews

How to apply for faster pockets loans?

You may also like: Loggerhead Insurance Reviews | Kennedy Funding Reviews | Birch Lending Reviews | Panther Lending Reviews | One Partner Advantage Reviews | protectspecial.com rEviews | Rate Chopper Loan Reviews

It is a simple five-minute process. You need to follow the given steps.

- You need to visit the official website and fill in the required information. Your application is then submitted.

- They will look for lenders in their network.

- You will connect to the lender and read the terms and conditions. If you have any objections, reject the offer and move on to the next one.

- Once you sign an electronic contract, the money is deposited into your account the next day.

- The amount borrowed, fees, and interest are deducted from your account on the decided date.

- In case of any late payment, you can contact and discuss it with the lender.

Requirements

You must fulfill the following requirements.

- You’re 18 years old or older.

- You are legally resident and working in the US.

- A proper income and a bank account of your own.

- A telephone and an email address of your own.

- Meet the minimum income limit.

Short term Loans

faster pockets loans offer short-period loans. It can be easily handled and provided quickly. It does not require much information like physical location. You can easily avail and pay back this amount. Would Like: Psnspot.Com Legit

Loan limit

You can now avail of a loan amount of up to $2500. This is a reasonable amount that anyone can pay off easily within a reasonable time.

Rates and charges

The charges may vary from one lender to another. However, no one can exceed the provided limit. The limit is $700, or 30% of your gross monthly income. No lender can cross it.

See More: Cashtab.Info Legit

Faster Pockets Loans: Comparison with other loan sites.

Many websites offer you short-term loans. Here is a list of a few below.

| Lender | Loan Type | Loan Terms | Minimum Credit Score |

| OnDeck Capital | Short Term | 3-24 months | 625 |

| CAN Capital | Short Term | 3-24 months | 550 |

| Fund box | Short Term | 12-24 weeks | 500 |

However, there is no such need for a minimum credit score like these loans. You must have a proper and steady income within a limit. Furthermore, the time duration depends on every other lender.

Customer Reviews: Are the Clients Happy?

The official website and Trust Pilot have no reviews from the customers. However, we looked on other sites like reseller ratings but couldn’t find anything. It seems that either the people are satisfied or there is low traffic on the website. We cannot find even a single review on faster pocket loans.

FAQs

What type of credit does it approve of?

It accepts every kind of credit card. Now, there is no specific restriction here. Explore More: Innovation Refunds Reviews

What happens to late payments?

Every lender has a different policy. You need to read the lender’s terms and conditions properly to know what happens with late payments.

Is there any discrimination?

No, your credit and personal loans are approved without any discrimination.

PROS:

- It has good terms and conditions.

- The scam advisor shows a trust score of 82/100

- You can easily apply.

- The proper encryption is provided for your data.

- It is a fast method.

CONS:

- The owner’s identity is not known on WHOIS.

- It has low traffic on the website.

- There is not even a single review from any client.

Final Thoughts

We bring our readers faster pockets loans reviews to help them find a potential option. The website is well managed and has very good policies. You can get short-term loans in any emergency. They offer a five-minute process, and your loan is accepted. However, the only issue is that there are no website reviews. Thus, it is hard to say if they are legit. But, there’s always a first time. We will recommend it, looking at their excellent terms and conditions.