Are you seeking a loan solution that goes beyond the conventional options? Look no further than the Infinity Plus Advantage. In this blog post, we will explore the remarkable features and advantages of Infinity Plus Advantage and assess its effectiveness in assisting with your loan needs.

If you’ve been searching for a more helpful and innovative approach to loans, keep reading to find out if this is the right choice for you.

Table of contents

Overview of Infinity Plus Advantage

Are you tired of struggling with high-interest debt and looking for a smarter way to save money each month? Look no further than Infinity Plus Advantage. As a pre-selected candidate for a personal loan, you can take advantage of a low 5.99% consolidation loan to simplify your financial situation.

They understand that everyone’s financial needs are unique. That’s why their dedicated advisers are ready to work with you, providing personalized solutions tailored to your specific circumstances. Say goodbye to generic approaches and hello to a loan built just for you.

Benefits

You may also like: Kennedy Funding Reviews | Birch Lending Reviews | Panther Lending Reviews | protectspecial.com rEviews | MyTPL Loan Reviews | Billshappen Loan Reviews | Global Capital Partners Fund Reviews

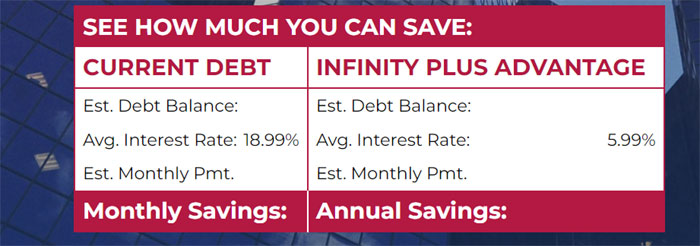

One of the most exciting aspects of Infinity Plus Advantage is the potential for substantial savings. By comparing your current debt situation to what our program offers, you can see the stark difference.

Interest Rate of 5.99% Compared to your Current Average Interest Rate of 18.99%

With an average interest rate of 5.99% compared to your current average interest rate of 18.99%, the monthly and annual savings can be significant. Imagine the possibilities when you have more money in your pocket each month.

Reduce Interest

One of the key advantages of Infinity Plus Advantage is the exceptionally low rates they offer. With their extensive data pool and experienced research team, they strive to secure the lowest rates available in the market. By reducing your interest rates, they help you save even more money over the long term.

No Pre-payment

Flexibility is another essential feature of it. They believe in giving you the freedom to manage your finances effectively. That’s why they offer loans with no pre-payment penalties. Pay off your balances whenever you’re ready without any additional fees or restrictions.

Rest assured, your personal information is safe with us. At Infinity Plus Advantage, they take the utmost care in safeguarding your data. Your information is kept strictly confidential, and they prioritize your privacy and security.

How to Avail of Service?

If you’re ready to take advantage of the remarkable benefits offered by this firm, the process to avail of the service is simple and straightforward. Follow these steps to get started on your path to financial freedom:

- Contact Infinity Plus Advantage: Begin by reaching out to Infinity Plus Advantage through their dedicated phone line at 866-591-4930. By speaking directly with their financial consultants, you can discuss your financial needs and explore the best solution for you. They will guide you through the process and answer any questions you may have.

- Provide Necessary Information: During your conversation with the financial consultants, be prepared to provide certain information. This may include personal details such as your name, contact information, and employment details. Rest assured that all information you provide is kept confidential and secure.

- Discuss Financial Situation: Infinity Plus Advantage aims to understand your unique financial situation to offer personalized solutions. Be open and transparent about your current debts, outstanding balances, and interest rates. This will help them evaluate how their service can benefit you and calculate potential savings.

- Loan Approval Process: After assessing your financial situation, the financial consultants at Infinity Plus Advantage will initiate the loan approval process. They will review your information, conduct any necessary verifications, and determine your eligibility for the low 5.99% consolidation loan. Their streamlined approach aims to provide next-day approvals, ensuring you can start enjoying the benefits as soon as possible.

- Review and Sign Documents: Once your loan is approved, you will receive the necessary loan documents for review and signature. Take the time to carefully read through the terms and conditions, ensuring you understand all aspects of the loan agreement. If you have any questions or concerns, don’t hesitate to reach out to the financial consultants for clarification.

- Utilize the Loan Funds: Upon signing the loan documents, you will gain access to the approved loan funds. Depending on your financial needs, you can use the funds to pay off existing debts, consolidate multiple loans into one, or address any other financial obligations. The aim is to simplify your financial situation and save money with the low 5.99% interest rate.

- Enjoy the Benefits: With the Infinity Plus Advantage service, you can now enjoy the advantages it brings. By reducing your average interest rate, you’ll experience monthly savings and potentially even significant annual savings. Take this opportunity to live a financially free lifestyle and make the most of the lower interest rates and flexible repayment options available to you.

Remember, this firm prioritizes your privacy and security. They have strict measures in place to protect your personal information, ensuring it remains confidential throughout the entire process.

Contact Information

Phone: 866-591-4930

For any inquiries, assistance, or to start the loan application process, you can reach them by calling the provided phone number. Their dedicated financial consultants will be available to guide you through the process, answer your questions, and provide the necessary information for availing their services.

Infinity Plus Advantage: What Are Customers Saying?

It appears that there is a lack of customer feedback or reviews for Infinity Plus Advantage on popular review platforms such as Trustpilot, SiteJabber, and others. Additionally, the official website of Infinity Plus Advantage does not showcase any client reviews or testimonials. The absence of a dedicated social media presence also indicates a lack of customer feedback.

It’s important to note that the absence of reviews doesn’t necessarily indicate the quality or legitimacy of a company. However, the lack of customer feedback and reviews may make it challenging to assess the experiences and satisfaction levels of previous clients.

To gain a better understanding of this company and its services, you may consider reaching out directly to their customer support or speaking with a financial advisor who can provide insights based on their knowledge and experience.

Red Flags

- Lack of Client Reviews: One concerning aspect is the absence of client reviews. Legitimate and reputable firms with years of experience typically have a track record of customer feedback and reviews. The lack of reviews raises questions about the credibility and legitimacy of Infinity Plus Advantage.

- No Social Media Presence: Another unusual aspect is the absence of any social media presence. In today’s digital era, established and trustworthy companies usually maintain an active social media presence to engage with their clients and promote their services. The absence of such presence can be seen as a red flag.

- Scam Advisor Warning: Scam Advisor, a platform that assesses the trustworthiness of websites, has flagged InfinityPlusAdvantage.com with negative indicators. The website’s owner has chosen to hide their identity, which is often exploited by scammers. Additionally, the low Tranco ranking suggests limited website traffic, raising concerns about its authenticity.

- Recent Domain Registration: The domain registration for InfinityPlusAdvantage.com indicates that the website is relatively new. With a lack of reviews and social media activity, it is essential to exercise caution as scam websites often use recent domain registrations to deceive unsuspecting individuals.

- SSL Certificate: While we found a valid SSL certificate, it is important to note that having an SSL certificate alone does not guarantee the legitimacy of a website. Scammers can also obtain SSL certificates, so it is crucial to consider other factors in conjunction with SSL certification when assessing a website’s trustworthiness.

Considering these red flags, we strongly advise conducting thorough research and due diligence before engaging with them. Verify their legitimacy through additional sources, consult trusted financial advisors, and consider seeking alternative options to ensure the security of your financial interests.

Is Infinity Plus Advantage Legit?

When assessing the legitimacy of Infinity Plus Advantage, it’s important to consider the presence of red flags that may raise concerns. Based on the provided data, several red flags have been identified, which require careful evaluation:

- Lack of Customer Feedback: The absence of customer reviews on reputable platforms like Trustpilot and SiteJabber, as well as no client reviews on the official website, is a notable red flag. Legitimate companies typically have a presence on review platforms and showcase feedback from satisfied clients.

- Absence of Social Media Presence: In today’s digital age, most reputable companies maintain an active social media presence to engage with customers and provide updates. The fact that Infinity Plus Advantage does not have any social media handles further adds to the red flags.

- Scam Advisor Warning: Scam Advisor has flagged InfinityPlusAdvantage.com with negative indicators. The website’s owner choosing to hide their identity raises concerns about transparency and the potential misuse of personal information.

Considering these red flags, it is advisable to exercise caution and conduct thorough research before engaging with Infinity Plus Advantage. It is important to verify the legitimacy of the company through additional sources, seek advice from financial professionals, and consider alternative options to ensure the security of your financial well-being.

Pros and Cons

PROS:

- Convenient Loan Options: Infinity Plus Advantage offers personal loans and debt consolidation solutions, providing convenience for individuals seeking to manage their debts and improve their financial situation.

- Personalized Approach: Infinity Plus Advantage understands that each individual’s financial situation is unique. They aim to provide personalized loan options and work with their customers to find the best solution for their needs.

- Competitive Interest Rates: Infinity Plus Advantage claims to offer competitive interest rates, which can potentially save borrowers money over time compared to higher-rate loans.

- Fast Approval Process: Infinity Plus Advantage may provide next-day approvals, allowing borrowers to access funds quickly, especially in urgent financial situations.

CONS:

- Lack of Customer Reviews: One of the major drawbacks is the absence of customer reviews on reputable platforms. This can make it difficult for potential borrowers to gauge the experiences of others and assess the company’s reputation.

- Limited Online Presence: Infinity Plus Advantage’s lack of a social media presence raises questions about their digital engagement and transparency. Many legitimate financial institutions actively maintain social media accounts to communicate with customers and provide updates.

- Unclear Transparency: It’s essential for financial service providers to be transparent about their terms, fees, and loan processes. Without sufficient information available, potential borrowers may find it challenging to fully understand the terms and make informed decisions.

- Warning Flag from Scam Advisor: Scam Advisor’s negative indicators regarding Infinity Plus Advantage can be a significant concern. It’s important to thoroughly research and evaluate the legitimacy of the company before committing to any financial transactions.

- Limited Information Available: The lack of comprehensive information about Infinity Plus Advantage’s loan products, eligibility criteria, and customer support options may make it challenging for potential borrowers to make informed decisions.

Conclusion: Infinity Plus Advantage Legit

In conclusion, the assessment of Infinity Plus Advantage raises significant concerns about its legitimacy and credibility. The absence of customer reviews on reputable platforms, the lack of a social media presence, and the warning flagged by Scam Advisor all contribute to a less-than-reassuring picture.

When considering a financial service provider, it is crucial to prioritize transparency, trustworthiness, and a solid track record. While Infinity Plus Advantage may not meet these criteria, there are alternative options available that offer reputable and reliable services.

It is advisable to explore established financial institutions, seek recommendations from trusted sources, compares interest rates and terms, and consult with financial advisors. Additionally, conducting thorough research, checking customer feedback, and considering online lender marketplaces can assist in identifying legitimate and trustworthy options.

Protecting your financial well-being is of utmost importance. Taking the time to evaluate and choose a reputable company will ensure that you receive the necessary support, fair terms, and secure handling of your personal information.

Ultimately, the decision is yours to make. By being diligent and discerning, you can navigate the financial landscape confidently and select a provider that meets your needs while prioritizing your financial security.

Alternative Options

- LendingClub: LendingClub is a peer-to-peer lending platform that connects borrowers with investors. They offer personal loans with competitive interest rates and flexible terms. LendingClub has a strong reputation and positive customer reviews.

- Prosper: Prosper is another peer-to-peer lending platform that provides personal loans for various purposes. They offer competitive rates, fast funding, and a user-friendly online platform. Prosper has been in operation for many years and has a solid track record.

- SoFi: SoFi is a modern financial company that offers a range of lending and financial services, including personal loans. They provide competitive rates, flexible terms, and unique member benefits. SoFi is known for its strong customer service and innovative approach.

- Marcus by Goldman Sachs: Marcus is the online lending platform of Goldman Sachs, a well-established investment bank. They offer personal loans with transparent terms, no hidden fees, and competitive interest rates. Marcus has a strong reputation for customer satisfaction.

- Avant: Avant is an online lender specializing in personal loans for borrowers with a range of credit profiles. They offer quick approvals, flexible repayment options, and competitive rates. Avant has served millions of customers and is known for its customer-centric approach.

When considering any alternative company, it’s important to review its terms and conditions, interest rates, fees, customer reviews, and overall reputation. Make sure to choose a company that aligns with your specific financial needs and goals.

Frequently Asked Questions

What is Infinity Plus Advantage?

Infinity Plus Advantage is a financial service provider that offers personal loans and debt consolidation solutions to individuals seeking to manage their debts and improve their financial situation.

How does Infinity Plus Advantage work?

Infinity Plus Advantage works by assessing your financial needs and offering personalized loan options. They aim to provide competitive interest rates, flexible repayment terms, and simplified loan application processes.

What are the eligibility criteria for a loan with Infinity Plus Advantage?

The specific eligibility criteria may vary, but common factors include a minimum age requirement, proof of income or employment, a valid bank account, and a good credit history. It’s best to consult with Infinity Plus Advantage directly to understand their specific requirements.

How long does it take to get approved for a loan with Infinity Plus Advantage?

The approval process can vary depending on factors such as the completeness of your application, the verification process, and the loan amount requested. Infinity Plus Advantage may provide information on their estimated turnaround times for loan approvals.

What are the interest rates and fees associated with Infinity Plus Advantage loans?

Interest rates and fees can vary based on factors such as your creditworthiness, loan amount, and repayment term. Infinity Plus Advantage should provide you with a transparent breakdown of the interest rates and any applicable fees associated with their loan products.

Are there any prepayment penalties with Infinity Plus Advantage loans?

It’s important to inquire about prepayment penalties directly from Infinity Plus Advantage. Some lenders charge a fee for early repayment, while others may allow you to pay off your loan balance without penalties.

How can I contact Infinity Plus Advantage?

To contact them, you can reach out to their customer service team by calling their provided phone number or by visiting their official website for contact information. They should be able to assist you with any inquiries or concerns you may have.