Many of you have become jobless after the emergence of COVID. This novel coronavirus affected many businesses. Most of you are looking for a meal plan to meet your ends. But nothing works. You need money for your business. Indeed, banks are there to help you, but not all of you get benefits from the banks. So, keeping these things in mind, there are many other means by which you can start your business or meet your needs. Most of you must have heard about the many websites that offer loans. But when it comes to money, can you trust anyone? Online shopping is the trend, and there is not much risk. But where there is money involved, it makes you think twice before using the services. Today, the firm we will review is WeFix Money.

WeFixMoney is a website that teaches people how to fix their finances online. It is a USA-based firm that aims to cater to US citizens. The motto of this name is to help clients in their financial crisis. Explore More: Mctrpayment Com Legit

Indeed, this sounds great, but are they really good? Is there any drawback to it? Is it safe to avail of services from them?

What is the fastest loan online?

What are the fastest ways to get a loan online? Many apps and websites claim to offer quick loan services. One of the quickest loan providers is Lightstream. It is the firm that can fund and also approve loans as quickly as possible. Apply online, pre-qualify, and fill out the form correctly for the quickest timeline.

See Also: Loyal Lending Reviews

What apps lend you money instantly?

You may also like: Loggerhead Insurance Reviews | Kennedy Funding Reviews | Birch Lending Reviews | Panther Lending Reviews | One Partner Advantage Reviews | protectspecial.com rEviews | Rate Chopper Loan Reviews

Here are the eight apps for advance.

- Dave — Best for Highest Cash Advance.

- Quick Cash Advances with Empower—Best for Quick Cash Advances.

- Earnin: Best for Earning-based Borrowing.

- PayActiv: Best for Short-Term Loans.

- Brigit: it is best for same-day loans.

- MoneyLion: It is Best for Multiple Options.

- same-day cash and advances up to $300.

About WeFixMoney

The goal of this firm is to help clients in their tough financial times.

It is a family-owned business and came into being in 2008, as per the firm that has maintained the top standard in client care and security. The goal of WeFixMoney is to support the client in solving their short-term financial needs. Read Also: Coffee Break Loans Reviews

Per their website, they never use your data for anything besides loan services. This firm is also a reputable member of the Online Lenders Association. t is the name that enjoys an A rating from the BBB. Here at this company, they feel pride in correctly working on customers’ behalf.

This firm claims to be the fastest in the world at lending money. From here, you can borrow the most for three to 36 months. The best part is that it is free same-day funding.

Is it too good to be true? Le, us find out in the upcoming section.

Don’t Miss: Cashtab.Info Legit

FAQS

How does it work?

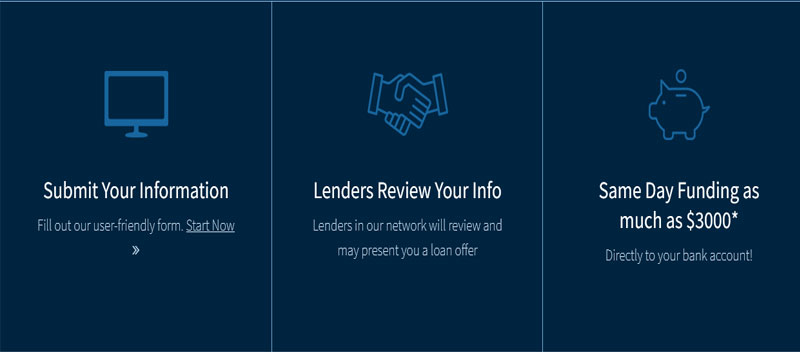

Applying for loans is a simple and easy task. All you require to do is follow the steps mentioned below.

- First, you will need to fill out an application.

- After that, the lender will review your form and offer you the loan.

- There is also same-day funding. The best part is that you can get as much as 3,000 USD.

What is the cost and APR?

WeFixMonwy is the firm, not the lender. So they do not have any control over the APR. They only represent APR. Why is that so? It is because it all depends on the data given by various lenders.

So the qualified client gets a loan with rates from 4.95% to 3.95%.

So here is your loan’s APR, and also the repayment will depend on the following:

- Creditworthiness

- lending or ledger partnership.

- state

Is it for all residents of the state?

Remember, some lenders’ services are not available to all of you. So, it all depends on the lender’s choices and legislation specific to that region.

Do wefixmoney charges?

Yes, wefixmoney does charge some fee.

Amount Interest rate Loan term fee Fee cost

$1,000 24.00% 12 months 3.00% $30.00

Is it safe to share the data?

This firm only uses the data for lending purposes. Related: Innovation Refunds Reviews

How can you reach their customer care services?

Here you can go for the chat part on the screen. So, the live agent is there to assist the client between 9 AM to 5 PM EST. The client can reach them by email at :

info@wefixmoney.com

by phone at 1-855-632-1673.

PROS:

- Quick loan approval

- YOu can lend up to 3000 dollars

- Same day amount deposit in your account

CONS:

- Mixed reviews about this services

- they charge you a hefty fee.

Wefixmoney.com reviews: What are clients saying about the services?

Review of the Trust Pilot.

Not a Happy Client

799% Interest rate, even tho my credit score is 670

I was quickly approved, but they were asking for 799% interest. I was planning to borrow this money ($800) only until the first of the month when I get paid. But I asked them how much together it would cost if I repaid the loan in its entirety in 11 days, and they told me it would cost me nearly $500.

Happy Client

I listen to 95.5 The Fish with Lin and…95.5 “The Fish”

I listened to 95.5 The Fish with Lin and Sarah, and they advertised that it’s quick and easy. I’m calling to let them know it was as simple as 1,2,3, and I was approved in minutes.

Review of Bank Standard

Due to changes in laws for my nation, wefixmoney could no longer provide a short-term loan. Which, at the time, I was unaware of. I became inundated with telephone calls and emails from 3 other creditors and submitted my information to my loan program. WFM could no longer house the loans because of the changes in the law, so they shipped my information. The lenders gave me advice that I needed BBB reports.

Another feedback: If I knew to double check, I’d have been paying OVER 2,000% interest (sad to say, I needed to cancel, and I’ll not be back).