Are you looking for a firm that connects you to the lender for the loan? If yes, then you must have heard of “green dollar loans.” But before connecting, we advise you to read the green dollar loan reviews.

What is this? It is the firm that connects users to loan lenders. It is simple to connect with the firm. All you need to do is visit their website, answer a few questions, and get your desired results. The best part is that they do not charge any fees. The lender pays them. So. it is the safest means to get a loan.

You can find many websites on the internet that offer the same services as Green Dollar Loans. But can you trust anyone? Of course not. When it comes to loans, you need to be very careful. You need to have detailed information on the company. Also, know the means, how to contact them, and much more. Don’t Miss: Proper Funding Reviews

In the green dollar loan reviews, we will look at various aspects. How does this website work? Does it change you? Is there any feedback about the services on the website? How can you rely on them?

What Is The Easiest Loan To Get?

The most manageable loans to acquire authorization for are:

- The payday loans.

- Also car title loans.

- A pawnshop loan.

- The personal loans with no credit check.

These kinds of loans offer fast funding and have the tiniest needs. Hence they are available to users with poor credit. (https://basicbluesnation.com) They are also expensive in most chances.

So, can you trust the hyped green dollar loans? Let’s find this out in the green dollar loan reviews by us.

About Green Dollar Loans

You may also like: Kennedy Funding Reviews | Birch Lending Reviews | Panther Lending Reviews | protectspecial.com rEviews | MyTPL Loan Reviews | Billshappen Loan Reviews | Infinity Plus Advantage

It is the firm that connects you to the loan lender. It scans your details and connects you with lenders. The best part is that they don’t charge you a penny. They get their fees from the loan lender.

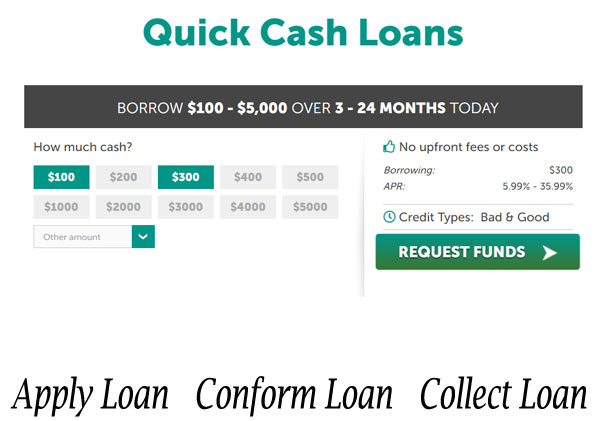

When we visit the website, we can see the small blocks with a small amount of amount in each. There you need to pick the one for like 300 dollars. Also mention the dollar amount and others. After that, hit the request fund button.

How to request a loan?

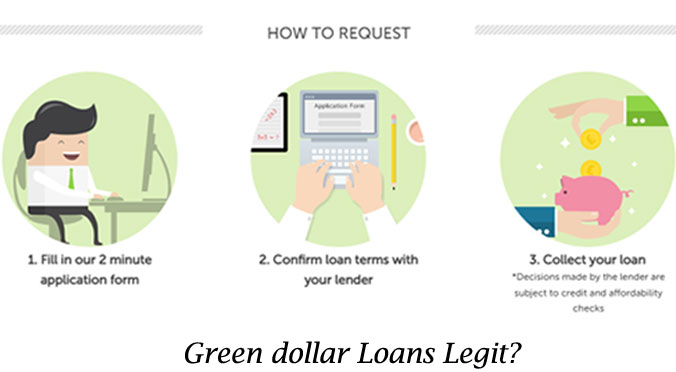

- 1. Fill in our 2-minute application form.

- 2. Confirm loan terms with the lender.

- 3. Collect the loan.

Remember the decisions made by the loan lender are subject to affordability and credit checks

FAQs

What is the APR Rates?

APR Rates Range From 5.99% to 35.99% Maximum APR.

What do they charge?

There is no fee.

Is this website leader?

The operator of this site is not a lender, never brokers loans to lenders, and never make loan or any credit decisions.

Are they representative?

They are not an agent, spokesperson, or broker of the lender and never endorse the lender or charge the loaner for services or items.

What is the maximum amount of loan you get?

The maximum amount is USD 5000.

Do they offer services to all States of the USA?

They do not offer their service in the following US states:

- Arkansas

- Connecticut

- New Hampshire

- New York

- Montana

- South Dakota

- Vermont

- West Virginia

- Indiana

- Minnesota

Does the form submission mean the loan approval?

The completion of the application form does not guarantee approval of a loan.

How do they fund the website?

They do not charge any fees for loaner requests. Lenders, lender networks, and marketers in their network pay them if they offer buyers a loan. Also, after reviewing their information via their service, the other loan options.

Who Is Eligible?

- One must have evidence of a government-issued ID.

- The applier also has a steady source of income.

- He has to be a citizen or permanent resident of the US or Canada.

- The applicant has to be 18 years old.

Green Dollar Loans Reviews By The Users

Green Dollar Loans have no BBB or SiteJabber page, and there are zero direct ways to contact them. You might want to view another loan source that has a history of great buyer interaction.

Pros and Cons

PROS:

- There is no fee.

- It has a short application form.

- Easy to apply.

CONS:

- There are borrower reviews.

- There isn’t much contact information.

The Final Verdict (Green Dollar Loans Reviews)

Here are our final green dollar loan reviews. We have found many things to like about this website and firm. The Green Dollar Loans have a phone number and an email address. That’s it. There is zero information about its parent firm or where it was found. So, there is a Better Business Bureau (BBB) or SiteJabber page. Until one applies, one will not learn how it treats borrowers.

Although the short application is usually a good point, The Green Dollar Loans’ application might be too short. It requests basic contact information and then directs you to call for more. It is not always a good sign.

There are many drawbacks, and we do not advise you to get any service from this store.