Are you considering applying for a loan with MyTPL? It’s crucial to do your due diligence and gather all the information you can before making any financial commitments. In this mytpl loan reviews blog post, we will delve into MyTPL loan reviews, providing you with an unbiased assessment of their services.

We will address the burning question on everyone’s mind: Is MyTPL legit? Stay tuned as we uncover the truth behind MyTPL loan reviews and help you make an informed decision.

Table of contents

Overview of Mytpl Loan

If you’ve recently received a mailer from TriPoint Lending with an enticing offer of a 5.95% interest rate and a generous $26,000 check, you might be curious about the company behind it. TriPoint Lending operates under the name MyTPL Loan and positions itself as a money lending platform. However, it’s important to carefully evaluate the details before jumping into any financial commitments.

When it comes to interest rates, the fine print reveals that the APR (Annual Percentage Rate) for first-time borrowers can range from 5.49% to a significant 30.00%. This broad range emphasizes the need to thoroughly understand the terms and conditions before accepting any loan offer.

It’s essential to note that MyTPL Loan is not a banking or financial institution. This distinction raises questions about the credibility and regulatory oversight of the platform. While non-traditional lending platforms can offer convenience and accessibility, potential borrowers must exercise caution and thoroughly research the company’s legitimacy and track record.

In addition to these concerns, MyTPL Loan has faced accusations of employing bait-and-switch tactics. Some customers have reported being enticed by seemingly attractive loan offers, only to find themselves enrolled in expensive debt relief programs. Such allegations highlight the importance of carefully reviewing all documentation and seeking independent financial advice before committing to any loan agreement.

When considering a loan from MyTPL Loan or any similar platform, it’s crucial to conduct thorough due diligence. Take the time to read and understand the fine print, including the terms, interest rates, and potential fees associated with the loan. Research the company’s reputation, reviews, and customer experiences to gauge its trustworthiness. It’s always wise to consult with a financial advisor or trusted professional who can provide objective guidance and ensure you make informed decisions about your financial well-being.

Remember, your financial security should be a top priority. Take the necessary precautions to protect yourself from potential scams or unfavorable loan terms.

Mytpl Loan Reviews: What Are Customers Saying?

You may also like: Kennedy Funding Reviews | Birch Lending Reviews | Panther Lending Reviews | protectspecial.com rEviews | Billshappen Loan Reviews | Infinity Plus Advantage | Global Capital Partners Fund Reviews

When it comes to assessing the credibility and legitimacy of a lending platform like MyTPL Loan, customer reviews can be a valuable source of insight. One commonly consulted platform for customer feedback is the Better Business Bureau (BBB). Let’s take a closer look at the reviews found there.

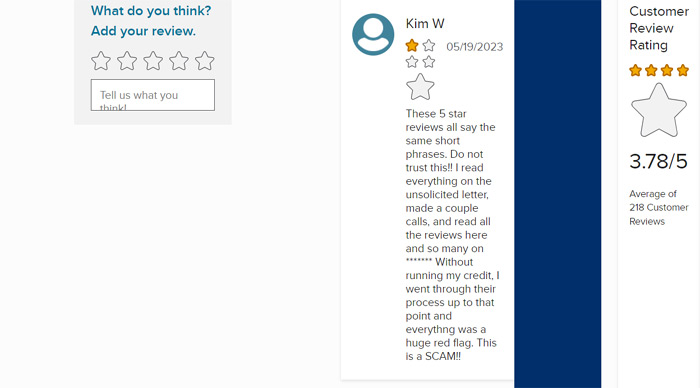

Upon analyzing the customer reviews on the BBB website, it becomes apparent that a significant number of the reviews share similarities. Many customers who have left 5-star reviews have expressed concerns about the consistency of the feedback. The short phrases used in these reviews raise suspicions about their authenticity. It is crucial to approach these reviews with caution and not place blind trust in them.

However, it’s important to note that there are also negative reviews that shed light on potential issues with MyTPL Loan.

Some customers have reported a similar experience of receiving unsolicited letters from the company. Upon further investigation, they conducted thorough research, including reading the reviews on various platforms. These customers encountered several red flags during the process and decided not to proceed. They warn others to be cautious, labeling MyTPL Loan as a scam.

While these negative reviews should not be disregarded, it’s essential to consider the credibility of the sources and weigh them against the positive reviews. Conducting a thorough analysis of all available information and reading reviews from multiple platforms can provide a more comprehensive understanding of the customer experiences with MyTPL Loan.

It’s worth mentioning that relying solely on one platform for reviews might not give a complete picture. It is advisable to explore other reputable sources and online communities to gather a diverse range of opinions and experiences from customers who have interacted with MyTPL Loan.

In conclusion, when researching MyTPL Loan reviews, it is crucial to approach customer feedback with skepticism. While some reviews on the Better Business Bureau point to potential issues and label the company as a scam, it’s important to consider the credibility of the sources and cross-reference with reviews from other platforms. Taking a balanced approach and thoroughly analyzing all available information will help you make an informed decision about engaging with MyTPL Loan or any other lending platform.

This place is a scam. They say you are preapproved but they simply submit your credit to actual lenders. If you have bad credit you will not get approved. They are a scam company that doesn’t care about you.

Very misleadingTHE FINE PRINT STATES: TriPoint Lending, LLC does not make and/or fund any product offerings, loans, or credit decisions. This solicitation does not constitute an offer to lend. TriPoint Lending will securely submit the information you provide to a lender.

Red Flags

When evaluating the credibility and reliability of MyTPL Loan, several red flags have been identified by customers and critics. These warning signs should be taken into account before engaging with the platform. Here are some key red flags to consider:

- Difficulty Accessing the Website: Many users have reported difficulties accessing the MyTPL Loan website. It seems that the website is frequently down or inaccessible in certain regions. This raises concerns about the platform’s stability and reliability.

- Dissatisfied Customers: Numerous customers have expressed dissatisfaction with MyTPL Loan’s services. Negative reviews highlight issues such as poor customer support, misleading terms and conditions, and unexpected fees. The consistent negative feedback from customers should be considered as a warning sign.

- Presence of Bad Reviews: In addition to the negative feedback on the Better Business Bureau, there are multiple other platforms where customers have shared their negative experiences with MyTPL Loan. These reviews highlight problems ranging from misleading loan offers to questionable business practices. It is important to pay attention to these reviews and consider their impact on your decision-making process.

- Domain Name Mismatch: One notable red flag is the discrepancy between the company name and the domain name. While the company operates under the name TriPoint, the domain name for their website is https://mytplloan.com/. This inconsistency in branding can raise doubts about the platform’s authenticity and professionalism.

Considering these red flags, it is crucial to approach MyTPL Loan with caution. Difficulties accessing the website, dissatisfied customers, the presence of bad reviews, and the domain name mismatch should all be taken into account when making a decision about engaging with the platform. Conducting thorough research, seeking alternative lending options, and consulting with financial professionals can help mitigate the potential risks associated with engaging with MyTPL Loan.

Is It Legit?

Determining whether MyTPL Loan is legit requires a comprehensive evaluation of various factors. While it is challenging to provide a definitive answer without access to specific information, the presence of red flags and negative customer reviews does raise concerns about the platform’s legitimacy.

The difficulties in accessing the website, the dissatisfaction expressed by customers, the presence of bad reviews, and the domain name mismatch all contribute to the overall skepticism surrounding MyTPL Loan. These factors should be carefully considered when deciding whether to engage with the platform.

To make an informed judgment, it is advisable to conduct further research, seek additional customer reviews from reputable sources, and consider alternative lending options. It may also be helpful to consult with financial professionals who can provide guidance and advice based on your specific financial situation.

Ultimately, the decision of whether MyTPL Loan is legit is one that you must make based on your own assessment of the available information and your level of comfort with the potential risks involved.

Pro and Cons

PROS:

- Quick and convenient loan application process.

- Potentially competitive interest rates for eligible borrowers.

- Flexible repayment options to suit individual financial circumstances.

- Availability of loans for a variety of purposes.

- Potential access to funds without requiring collateral.

CONS:

- Difficulties in accessing the website in certain regions.

- Negative customer reviews raise concerns about service quality.

- Inconsistencies in branding with a domain name mismatch.

- Potential undisclosed fees or hidden charges.

- Limited information about the company’s regulatory oversight.

Conclusion: Mytpl Loan Reviews

In conclusion, when considering MyTPL Loan as a potential lending option, it is essential to carefully weigh the pros and cons. The quick and convenient loan application process, competitive interest rates (for eligible borrowers), flexible repayment options, and availability of loans for various purposes are positive aspects to consider.

However, it is crucial to be cautious due to the difficulties in accessing the website, negative customer reviews expressing dissatisfaction, the domain name mismatch, potential undisclosed fees, and limited information about regulatory oversight. These red flags raise concerns about the platform’s legitimacy and reliability.

Before making any decisions, it is highly recommended to conduct thorough research, seek additional customer reviews from reputable sources, and consider alternative lending options. Consulting with financial professionals can also provide valuable guidance tailored to your specific financial situation.

Ultimately, your financial security and peace of mind should be the top priority. Taking the time to make an informed decision, considering both the pros and cons, will help you navigate the lending landscape and choose the best option that aligns with your needs and safeguards your financial well-being.

Alternative Options

- Wells Fargo: Wells Fargo is a well-known bank that provides a wide range of loan options, including personal loans, auto loans, and home mortgages. They also offer savings accounts and other banking services.

- Chase Bank: Chase Bank offers various loan products, such as personal loans, home loans, and auto loans. They have a strong presence nationwide and provide savings accounts and other banking solutions.

- Bank of America: Bank of America is another major bank that offers loan services, including personal loans, home equity loans, and business loans. They also provide savings accounts, certificates of deposit (CDs), and other savings options.

Frequently Asked Questions

Q: How do I qualify for a loan?

A: Loan eligibility requirements vary depending on the lender and the type of loan. Generally, factors such as credit score, income, employment history, and debt-to-income ratio are considered during the qualification process.

Q: What documents do I need to apply for a loan?

A: The documentation required can vary but commonly includes proof of identity (such as a driver’s license or passport), proof of income (pay stubs or tax returns), bank statements, and proof of residence (utility bills or lease agreements).

Q: What is the difference between a secured and an unsecured loan?

A: A secured loan requires collateral, such as a home or car, which the lender can seize if the borrower defaults on the loan. An unsecured loan does not require collateral and is typically based on the borrower’s creditworthiness.

Q: How long does it take to get approved for a loan?

A: The approval time can vary depending on the lender and the complexity of the loan application. Some online lenders offer quick approvals within a few hours, while traditional banks may take several days or even weeks.

Q: What is the interest rate on the loan?

A: The interest rate is determined by various factors, including the borrower’s credit history, loan amount, and loan term. Lenders offer different interest rates, so it’s important to compare rates from multiple lenders to find the best option.

Q: Can I pay off my loan early?

A: Most lenders allow borrowers to pay off their loans early. However, it’s important to check the loan terms for any prepayment penalties or fees that may apply.