Are you worried about those unexpected bills? Is it getting difficult to manage expenses this month? Are you finding it hard to arrange money? Sometimes the budget goes out of range, and we need help paying the bills. Medical bills, car repairs, and other extras get added, especially at the end of the month.

However, internet banking has made everything easier. Many loan companies help you in such difficult times. (canadianpharmacy365.net) One such is northern star lending. The procedure is usually hard, but this company is here to make your life easier.

Northern star lending is a merchandise company operated by an Indian tribe. They are here to help you in such difficult times. But what is the procedure? How much is there a loan limit? What about the interest rate? Here we are today with northern star lending reviews to answer all your doubts. Related: Green Dollar Loans Reviews

About Northern Star Lending

The Northern Star Lending is a tribal company under an Indian tribe in Wisconsin. It is a federally recognized tribe that offers loans to qualified applicants. The credit score is the least important in their process. The most important thing is that you are in need and can pay off this loan in installments soon.

They aim to offer installment loans to their customers. This way, you can slowly and steadily pay off the monthly amount. You can get this amount within 24 hours, which is good for emergency cases.

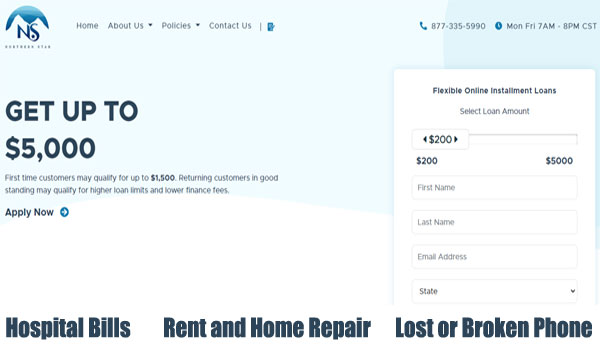

What Kind Of Emergencies Are Funded By Northern Star lending?

You can get a good payday loan for your daily expenses.

- Medical bills.

- Lost or broken phone.

- Vet bills.

- Owed taxes.

- Moving expenses.

- Utility bills.

- Car repair.

- Rent and home repairs.

What Is the Loan Limit at Northern Star Lending?

You may also like: Kennedy Funding Reviews | Birch Lending Reviews | Panther Lending Reviews | protectspecial.com rEviews | MyTPL Loan Reviews | Billshappen Loan Reviews | Infinity Plus Advantage

You can get an amount of $1500 as a first-time customer. This amount is enough to cover the extra daily expense. However, if you pay the installments timely, you are one of their regular customers. Moreover, they even offer a loan of $5000 to regular customers.

What Is the Application Procedure?

The loan application process is easy at Northern Star Lending. You just need to go through the following steps.

- You need to visit the official website.

- An application form is visible on the front page.

- Fill out the information regarding your home, bank statements, driving license, and personal information.

- Submit the application form.

- They will notify you within a day.

- If the loan is accepted, you will receive the payment as early as the next day.

What Is the Annual Percentage Rate?

The Annual Percentage Rate (APR) applicable on your loan amount ranges from 630% to 780%. It usually depends on the payment schedule and the amount of your loan. The APR amount is reasonable as compared to others.

However, they may add additional charges if you do not pay the installment amount. Thus, make sure you repay every installment.

Can You Change the Installment Date?

You can apply three days prior to changing the date of repayment. This is feasible for both parties. It saves you from the risk of being overcharged by late payments. Thus, make sure you remember all the due dates.

Customer Reviews: Are They Satisfied?

The official website does not have any reviews. However, the Trust pilot shows some good reviews. They have a 4.1 rating with more than 100 reviews. Most of the comments are 5-star. One of the users says that “The gentleman that helped us. Very professional, patient, all around, very nice. I would like to know my next step to get into the account. I plan to pay off a loan of 9f 575.00 I have now with part of the funds.”

Many good reviews are seen. However, one user says, “Told me I was approved for a certain amount, signed the paperwork, and then gave me a much less amount. As a result, I could not pay an emergency bill resulting in a material loss that cannot be repaid.”

Thus, mixed reviews are available. Some have very good experiences, while others have the worst ones.

Pros and Cons

Let us enlist all the pros and cons.

PROS:

- They offer short-term loans.

- The policy is good.

- Response time is great.

CONS:

- They do not facilitate long-term loans.

- Some poor reviews are also present by a few users.

Bottom Line

We bring you northern star lending reviews to help you find a good company. They provide short-term loans to easily tackle emergencies. The initial limit for the loan is low. However, if your record is good, you can avail yourself of a loan of up to $5000. The reviews are good, with mostly 5-star ratings. But some customers say they did not receive the money even after being accepted. The overall performance is good, and we suggest you try it.

I just got approved for a $575.00. My payments would be $195 2x a month FOR A YEAR!!!

That comes out to $4,680 I’d have to pay back on a $575.00 loan!!!!

ARE YOU KIDDING ME??? That’s absolutely insane.

I’ll just put $200 aside for the next 3 paychecks and have $25 more than what they were gonna loan me!

That’s ridiculous!!!

No… I’m good!

There should be a Negative Star for this company. A total scam.

I spent half the day on 02/07/23 talking to their reps about my pending loan of which I signed two different agreements for that they sent me…which was rather strange I though. The first person I spoke with said the only thing in question on my pending loan was my recent loan I took with another lender (which I found odd by the way) and wanted a statement which I provided. They said they would call me back. Later another rep called me back and said we needed to do a joint call with that lender to verify my account was current of which we did. They told me they had everything they needed and the loan was underway in Underwriting.

Less than an hour later another rep called me and said we needed to do a joint call with that Lender to verify my account was current of which I told them we already did. They were like sorry but it was not recorded so we need to do it again. So once again we did a joint call with the other Lender (which again I found odd) and verified my loan with them was current. The rep then told me they had everything they needed and everything looked good and my loan was approved and would be funded next business day which would have been 02/08/23. I called back on 02/08/23 to see when my funds would be deposited and was told my loan was denied? I expressed to the rep I was told my loan was approved and they were like sorry you will be getting a letter. How absurd is that!

Needless to say this company has proven to me that they are a crooked and unprofessional company that does not know how to operate a business or inform potential clients of accurate information. I was misled and lied to.

They should be ashamed of themselves.